THE INFLUENCE OF EUROPEAN INTEREST RATES AND UNCERTAINTY ON THE ECONOMY OF BOSNIA AND HERZEGOVINA

DOI:

https://doi.org/10.7251/EMC2301078ЈAbstract

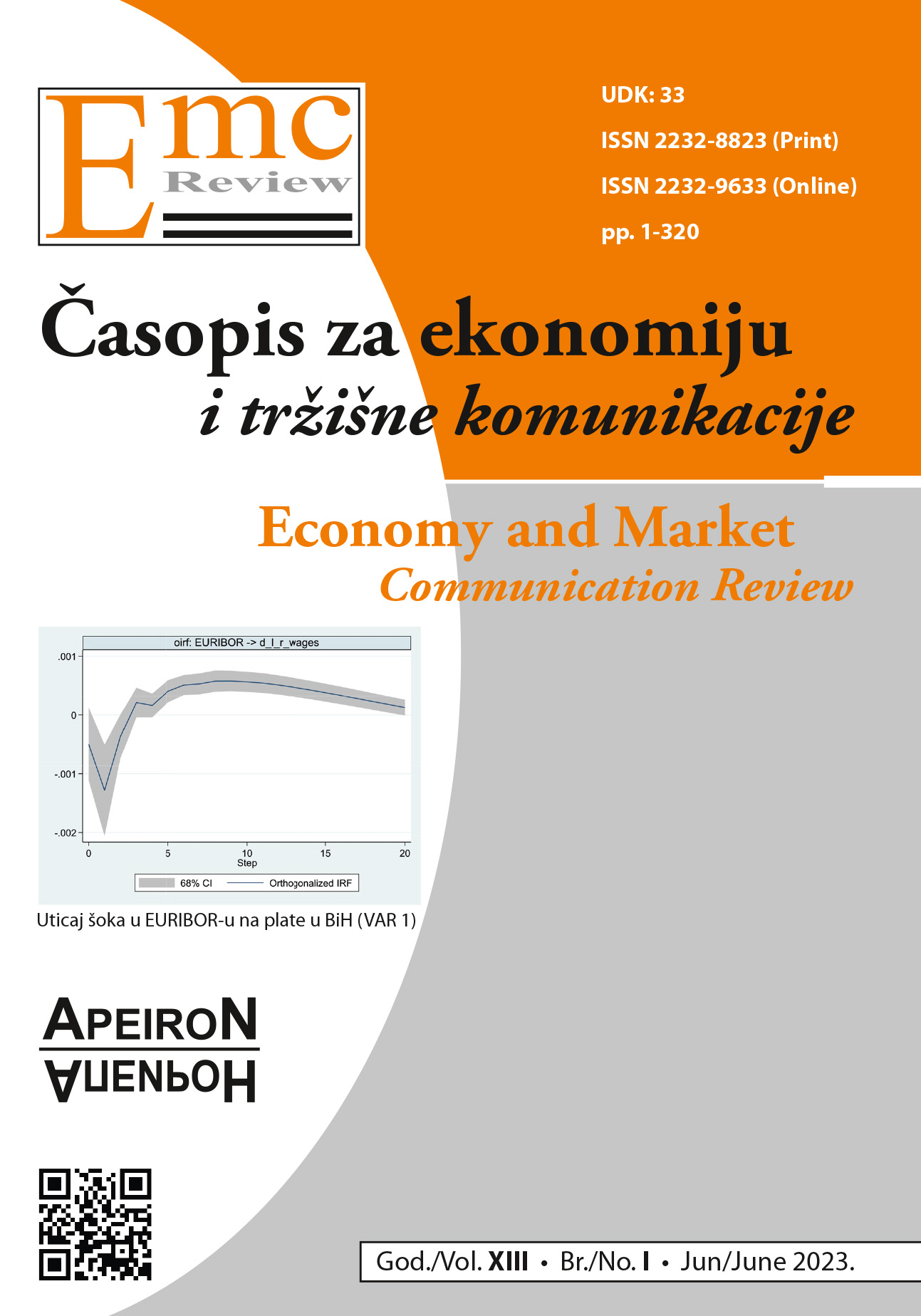

The economy of Bosnia and Herzegovina is a small and open economy, and in addition, it functions in the regime of a fixed exchange rate and limited monetary sovereignty. These facts could enable the influence, first, of the European Central Bank, and then also of the general economic sentiment in the European Union, on the economic processes in BH. The subject of this research was the connection between BH’s economy with its European neighbored and the aim of the research was to measure the degree of influence of European economic variables on BH’ economy, i.e. on its real sector. We were interested in whether, and with what intensity and duration, the benchmark interest rate on the interbank money market in Europe affects wages, employment, industrial production and prices in BH. We started from the assumption that, considering that BH banks are predominantly owned by banking groups from Italy and Austria, there must be an influence of the monetary policy of the ECB, through Euribor, on BH’s economy. But, its influence due to the high domestic sources of financing should not not be too strong. The second channel of influence that we were interested in is related to the effects of growing uncertainty in the EU on the real part of BH’s economy. Given to the fact that the financial markets in Bosnia and Herzegovina are very underdeveloped, with the entity’s public debt market (the Republic of Srpska and the Federation of Bosnia and Herzegovina) as its most developed parts, we assumed a low impact of changes in the degree of uncertainty in which the European financial markets operate on the financial markets of BH, and therefore also on BH’s economy. Conducted research, that is, its main findings showed that our assumptions about the strength of the influence of the European interest rate and uncertainty in the European financial markets on BH’economy were correct. Interest rate channel is passable, and European interbank interest rate influences BH’s economy. The foreign interest rate has highest impact on employment and industrial production and its influence on wages is smaller. These influences are short-term and on average not so intensive, which need to be motive for introduction of new BH’s monetary policy instruments. The consumer prices in BH are not determined by foreign interest rate, and according to that the price dynamic in BH is outside of ECB’s monetary policy scope That is new reason for creation of BH’s monetary regime with greater extent of discretion. In period analyzed changes in uncertainty in European financial market didn’t have significant influence on wages, employment and consumer prices in BH’s economy. Volatility growth on European stock exchanges is visible only in industrial production. The industrial production doesn’t decline on uncertainty impact, but it decreases ex post, intensively and long-term. Relatively low and short-term impact of European financial market on BH’ economy shows difference in BH and European business cycle which imply need for further development of BH’s monetary policy.